The HUBZone contracting program, while well-intended to provide economic and employment opportunities in otherwise low income, high unemployment areas, must nonetheless connect HUBZone firms with government contracts, the overwhelming majority of which are not located within a HUBZone.

If HUBZone firms are to experience growth, they will need to utilize the local labor force in the area where the contract is to be performed, in addition to utilizing the labor force residing in their HUBZone to perform indirect labor functions. As a company’s direct labor force grows, their indirect labor will also grow, producing more employment opportunities within the HUBZone, thereby fulfilling an intent of the program.

The HUBZone Empowerment Act became law through the Small Business Reauthorization Act of 1997. The Small Business Administration (SBA) regulates and implements the program, determines the businesses eligible to receive HUBZone contracts, maintains a database of qualified HUBZone businesses, and adjudicates protests of eligibility to receive HUBZone contracts. HUBZone contracting encourages small businesses to locate in and hire employees from economically disadvantaged areas of the United States. HUBZone entities may receive competitive advantages in winning federal contracts.

The HUBZone program was designed to promote economic development and grow employment opportunities in metropolitan or rural areas with low income, high poverty rates, and/or high unemployment rates, by targeting federal contracts to small businesses in these areas. This is a conceptual shift where contracting preference is targeted at geographic areas with specified characteristics, as opposed to targeting it to people or businesses with specified characteristics.

There are five classes of HUBZones: qualified census tracts; qualified counties; Indian reservations; difficult development areas; and military bases closed under Base Realignment and Closure Act. The program uses three mechanisms for targeting contracts to HUBZone businesses: set-asides, sole source awards, and a 10% price preference; with set-asides being the preferred method of matching HUBZone businesses with federal opportunities.

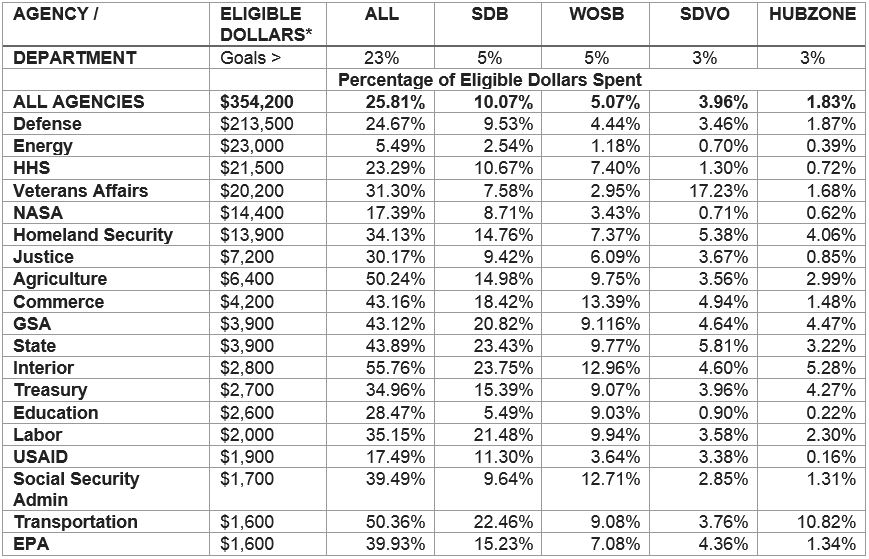

The government-wide goal for most agencies is to award at least 3% of their eligible federal contracting dollars to HUBZone-certified firms [see 15 USC 644 (g)]. Almost all federal agencies participate in the HUBZone program. Although several individual agencies often met or exceeded this goal, it has never been achieved government-wide.

The following table shows the performance of HUBZone against other small business goals in fiscal year 2015.

Small Business Contract Spending by Federal Agencies (FY15)

Eligible Dollars – Excludes Some Special Programs

20 Largest Spending Agencies

*Millions of Dollars (rounded)

Revised January 2017; Fiscal 2016 data will not be official until mid-2017

The table shows that HUBZone demonstrates tremendous potential for growth. Peaking in 2009, the HUBZone program nearly reached its 3% goal, finishing just short at 2.7%. Since 2011, as funding for the program has decreased, so has the use of HUBZone businesses, now averages 1.74% of procurement budget between 2013-16. ALL = All Small Businesses; SDB = Small Disadvantaged Businesses [including 8(a)]; WOSB = Women-Owned Small Businesses; SDVO = Service-Disabled Veteran-Owned Small Businesses; HUBZONE = HUBZone-Certified Small Businesses. Source: smallbusiness.data.gov.

Early program critics questioned if the program would offer enough incentive for business to choose to locate/relocate in areas they would otherwise avoid. HUBZones are rarely located at or near Federal installations or business locations; could the failure to achieve the government’s goal be mitigated by amending the 35% requirement against all employees employed by the business, to a 35% requirement against indirect employees only? Here is a practical example:

Company “R” is a small business whose principal office is located on an Indian Reservation in South Dakota approximately 200 miles from the nearest Federal installation or location of business. Company R has 20 employees at its principal office: 1 executive, 3 finance, 2 HR, 1 compliance, 3 business development, and 2 project managers and 8 direct employees who work in the company’s primary business line. All the employees (10 indirect; 10 direct) live on the reservation. Meeting the all requirements to include the 35% mandate, the company certifies as a HUBZone.

Implementing its growth strategy, Company R subcontracts to a prime for a contract whose place of performance is Huntsville, AL. The subcontract is to provide 100 full time equivalent (FTE) employees. None of the new direct employees live in the HUBZone where Company R is located, nor in any adjoining HUBZone. As a result, of the 120 employees, only 20 (16.7%) live in the HUBZone. Company R can no longer certify as a HUBZone company.

This example, shows that as a practical matter, a company in a HUBZone is not incentivized to secure a HUBZone certification when performance on a federal contract will likely not be located near or in the HUBZone. With 20 employees all residing in a HUBZone, Company R is capped as a 57-person labor force – in other words, either priming or subbing on a 37 FTE contract vs. the full 100 FTE. However, if Company R were to ONLY count its indirect employees as the basis for the 35% requirement, it could continue as a HUBZone concern.

Therefore, to expand the HUBZone program, legislation should be submitted to amend the Small Business Act and 13 C.F.R. 126.200 be amended to require a HUBZone small business to:

- Maintain a principal office located in a HUBZone and ensure that at least 35% of its indirect employees reside in a HUBZone as provided in paragraph (b)(4) of this section; or

- Certify that when performing a HUBZone contract, at least 35% of its indirect employees will reside within any Indian reservation governed by one or more of the Indian Tribal Government owners, or reside within any HUBZone adjoining such Indian Reservation

If these changes are made, HUBZone businesses will have the potential to grow their companies and better serve the economic development needs of the areas in which they are located. As these companies grow, their workforce from the HUBZone area will also grow to meet the company’s management and overhead needs. Finally, these changes will better position government agencies to make their HUBZone goals.

Michael Anderson, Executive Director

Michael “Keawe” Anderson, is a Native Hawaiian who is passionate about advancing Native economic development. He is NACA’s principal advocate of policies and programs for the participation of Native American Tribes, Alaska Native Corporations, Native Hawaiian Organizations, and individually-owned Native businesses in the federal marketplace.

NACA represents Native community-owned businesses who serve a million tribal members or shareholders by applying their earning from government contracts to the benefit of their communities. NACA recently added individually-owned Native businesses as NACA Associates. In total, these businesses provide quality goods and services to federal agencies in all 50 states and internationally.

A graduate of the Air Force Academy, Mike has a master’s in business administration from the University of Northern Colorado, a master’s in strategic military studies from the Air University, and a master’s certificate in government contracting from the George Washington University.

Native American Contractors Association – 750 First Street NE, Suite 950 – Washington, DC – 20002

Phone: 202-758-2676 Email: keawe@nativecontractors.org Website: www.nativecontractors.org

GovCon Voices is a regular feature dedicated to providing SmallGovCon readers with candid news, insight and commentary from government contracting thought leaders. The opinions expressed in GovCon Voices are those of the individual authors, and do not necessarily reflect the opinions of Koprince Law LLC or its attorneys.