If federal contracting had a proverbial town square, it would be SAM.gov. So much federal contracting activity flows through or starts there. A large portion of SAM is contractor information. Contractors are required to be on SAM and are expected to keep their profiles on SAM updated. A “hot off the presses” GAO ruling has confirmed that the timing of SAM registration can make or break a contractor’s winning bid.

Continue reading…SmallGovCon Week in Review: March 25-29, 2024

We hope you had a great week and are enjoying some nice spring weather. Here are some happenings from the federal government contracting world this week, including more updates on the funding package, upcoming information on complying with labor regulations, and new policies on AI. Enjoy your weekend!

Continue reading…Back to Basics: Similarly Situated Entities

If you are a small business government contractor who ever utilizes subcontractors to complete federal set-aside contracts, knowing what a “similarly situated entity” is for a given contract is vital to your success. So, let’s take it back to the basics of “similarly situated entities.”

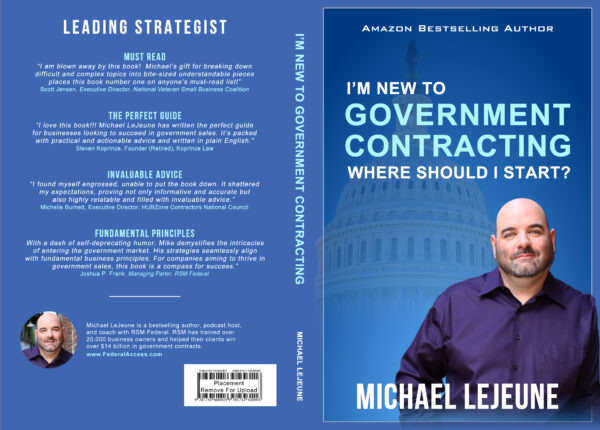

Continue reading…Michael Lejeune’s New Book Now Available!

Please check out the new release from my friend, federal contracting expert Michael LeJeune.

Bestselling author and GovCon expert, Michael LeJeune is releasing his new book, “I’m New to Government Contracting – Where Should I Start?” on March 26th. Michael’s new book has all that a growing federal contractor needs to get started on a path to success. I was especially struck by the emphasis on avoiding shortcuts. As a GovCon attorney, we sometimes hear about get-rich-quick schemes involving federal contractors. Michael puts those to bed. For instance, you have to read his takedown of the middleman strategy if you have heard about that online.

But he also provides time-tested strategies for getting into government contracting and for growing your business. As one example, there is a nice overview of how to do an evaluation of your business and examine how your processes will translate to government contracting. The book also has great explanations and concrete checklists for things like 9 core marketing tools and 7 key ways to build your pipeline.

Register here to get a special 60% discount link on the day of launch: https://mailchi.mp/f3520f7e9b0a/5snc8wdmhp.

GAO: Small Business Teaming Agreement Must Follow Solicitation Guidelines

As we often tell people, language in a teaming agreement is important for a federal contract. But so is complying with the terms of a solicitation. A recent GAO decision hinged on a very specific portion of the language in a teaming agreement that was required as part of a solicitation. Because the contractor did not include the required language in a teaming agreement, it lost out on an award.

Continue reading…Why File: A Request For Equitable Adjustment

If you are a government contractor, odds are you have faced a situation where some aspect of the contract you were performing changed outside of your control, or you ran into something that neither you nor the government expected. As a result, your work requirements likely changed, and with that, your costs likely changed as well. When this happens, there are multiple paths to getting reimbursements for those new costs, and one of the most common ones is a request for equitable adjustment. Today, we’re going to explore when you should submit a request for equitable adjustment as opposed to the other routes.

Continue reading…SmallGovCon Week in Review: March 18-22, 2024

Hope you are having a good week readers, and enjoying some March Madness. While it looks like spring in our neck of the woods, in this part of the country the weather can change quickly. We joke around that we must always have every type of coat or jacket at the ready on any given day. Never a dull moment! Speaking of never a dull moment, the NCAA tournament has started and there certainly have been some great games in the first round! How’s your bracket doing?

We hope you had a great week and are enjoying some nice spring weather as well as some exciting basketball. Here are some happenings from the federal government contracting world this week. Interesting updates include an update on OASIS+ timing and enhancing whistleblower protections for DoD contracts. Enjoy your weekend!

Continue reading…